Best Crypto Trading Strategies

In the article, we will discuss the best crypto trading strategies. Some people enjoy making fast trades within a day and reacting to every little price change in real-time.

On the other hand, some others like taking their time by studying market trends for bigger rewards over an extended period of time.

This guide helps you find a trading approach that suits your personality, whether it’s fast-moving trades or a more focused and long-term strategy.

Best Trading Strategies for Crypto

The choice of the best trading strategy for crypto trading is not a straightforward matter. It depends on various conditions like current market trends, personal risk tolerance, and your knowledge or experience in this field.

This means that there is no single universal strategy that can be considered as the best for crypto trading.

Additionally, when deciding which cryptocurrency to trade with, you need to take into account other factors such as its liquidity and market volatility. These aspects greatly impact the effectiveness of different trading strategies.

Moreover, if we consider all other things equal, the choice of strategy also relies on how long you want to hold a position in your trades.

Below, we’ll explore some of the most popular cryptocurrencies trading strategies.

Moving averages crossovers

This strategy for trading cryptocurrency is old and famous, helping to notice when the trend might shift. It is a top strategy in crypto trade that relies on two moving averages with distinct time lengths; one long, one short.

People who like swing trading usually use moving averages that count 50 and 200 days. If they do day trading, then moving averages for 9 or 20 periods are better. Also, you can read about the crypto scalping strategies.

To filter out some incorrect signals, we use the RSI indicator. If the short moving average goes above the longer one and RSI is more than 50, it suggests to start a long position.

In the same way, if the short-moving average goes down over the long one and RSI is under 50, it means you should start a short position.

A job is often finished when there is a different sign from an MA crossing or by applying a Trailing Stop Loss.

The method for exchanging cryptocurrency is most effective when a clear trend can be observed. It is advised not to apply this strategy when the prices are moving horizontally without much change.

While it’s true that moving averages come after the trend and therefore their crossing might not give the most ideal timing to start a trade.

Range trading

Range trading, a strategy used for sideways price movements, is not complicated in its nature. When the price is moving sideways, it forms similar or nearly similar local highs and lows that work as resistance level and support level respectively.

Although reduced volatility lessens the possibility of making profit, it can also imply lesser danger because of the relatively predictable nature of these highs and lows.

Before starting a position in range trading, you need to verify the range. This signifies that price has formed two identical highs and lows without any intermediate point being broken above or below.

When the range is identified, the most basic trading approach involves buying close to support and selling nearby resistance.

Traders who have more experience may also start short positions close to the resistance level and end them near support, earning from price shifts in both ways.

Stop Loss in range trading is positioned outside the range limits. Still, it is important to keep an eye out for possible signs of a breakdown, like growing trade volume.

A type of range trading is called channel trading. In this situation, the fundamental rules are similar.

However, it’s not traded within a flat range but instead in a channel created by active support and resistance lines. Unlike range trading, this strategy is used for trading cryptocurrency when a clear bullish or bearish trend is identified.

Breakout trading

Many people like to use breakout trading for cryptocurrency because it works in different situations. When the price goes past important levels, this is what we call a breakout.

When the price breaks above, what was resistance before now becomes support. And when it goes below, what was supported turns into resistance.

Price movements in the market often happen when there are breakouts. These big changes in prices usually come from breaking out of certain shapes like price channels or patterns that look like triangles, flags, or wedges.

In breakout trading, you start a trade when the price goes beyond an important point like a resistance level or a trend line. Normally, you would enter the trade at the beginning of a new candle following the breakout.

The Stop Loss is positioned a little bit under the level that has been broken, or if it’s a short position, then just above. The Take Profit is usually set ahead of the upcoming important level.

Occasionally, a Trailing Stop Loss is utilized as a Take Profit; this type of stop loss follows the price movement toward the breakout direction.

It is significant to have the ability to identify a false breakout, that is, when the price goes through an important level but quickly comes back to it. Often you will see low trading volume during the time of this breakout. A clear sign of a genuine breakout is when the candle body on the chart is significantly large.

Furthermore, numerous traders choose to reduce risk by initiating a position once the price has gone back to the breached level and recoiled from it instead of when the breakout is happening.

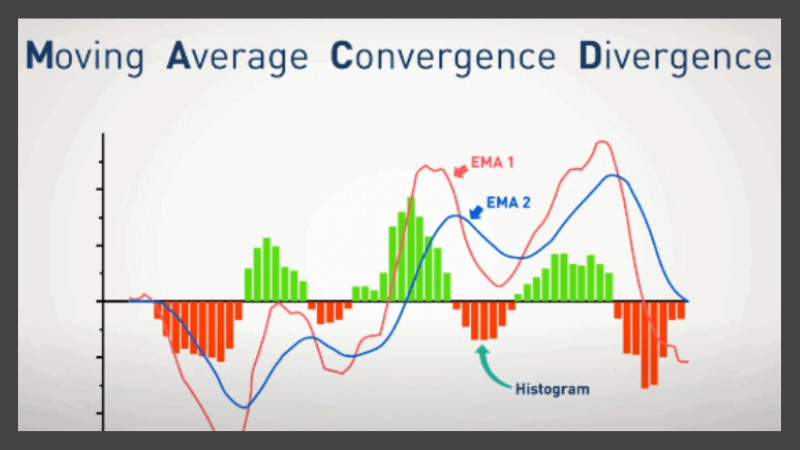

MACD

The MACD, which stands for Moving Average Convergence Divergence, is very commonly used in trading. But it’s not possible to create a strategy that always makes a profit using only the MACD.

For this reason, people often use other instruments like Stochastic, RSI and Parabolic SAR along with MACD.

Many people like and use a basic method to trade cryptocurrency, which involves MACD together with Parabolic SAR and an Exponential Moving Average over 10 candles (EMA10).

It is recommended to close a position when the MACD or Parabolic SAR indicate that there is a trend shift.

Since there is still the chance of receiving incorrect signals from this mix of indicators, it’s very advised to use a Stop Loss.

The MACD does not work so well for trading in short time periods. It works better for one hour or longer time periods.

What is Crypto Trading?

Crypto trading is a way to earn money from digital currencies by purchasing and selling them when the price is good. It carries both big risks and the potential for large profits.

Crypto trading has many similarities with traditional financial instrument trading, but there are also important differences.

These differences come from the fact that the crypto market is new and not so much regulated and because it often has lower amounts of trading activity.

What is a Crypto Trading Strategy?

In cryptocurrency trading, depending on luck is not enough. It’s important to have a definite plan for starting trades and earning money.

A strategy for trading cryptocurrency is a collection of guidelines that explain how you carry out your trades. It typically encompasses the following:

- ✔️ Rules for selecting an asset to trade

- ✔️ Rules for analysing the market

- ✔️ Rules for opening and closing a position

- ✔️ Rules of risk management.

Conclusion of Best Crypto Trading Strategies

To become good at trading cryptocurrencies, it is important to know the best crypto trading strategies, handle risks carefully, and know the market well.

Keeping up-to-date with information, getting practice regularly, and changing your methods when the market shifts will help make your trading better.

Keep in mind, to trade well is not winning each time but making choices based on knowledge and looking after your investments for success over a long period.

F.A.Q

What is the most profitable cryptocurrency trading strategy❓

The most profitable crypto trading strategy varies for each person, but many find success with day trading because it uses the market’s quick changes. However, it needs a lot of attention, knowledge, and good risk management. The best strategy is one that fits your goals and comfort with risk.

Can beginners profit from crypto trading❓

Yes, beginners can make money with crypto trading, but it requires learning about the market, starting with small investments, and using risk management strategies to minimize losses.

Do I need bots for crypto trading❓

No, bots are optional; many trades successfully without them.

Is technical analysis important in crypto trading❓

Yes, it’s key to making informed decisions.

What is best cryptocurrency trading strategies for beginners❓

For cryptocurrency trading beginners, starting small, diversifying investments, and employing long-term strategies like HODLing or dollar-cost averaging while staying informed about market trends and practicing risk management are key to navigating the volatile crypto markets successfully.