Is Trading Gambling?

Trading and gambling have been associated with each other for centuries, but are they the same? Many people believe that Trading is just another form of gambling, while others believe it is an entirely different activity. In this article, we will explore what Trading and gambling involve and evaluate whether or not Trading can truly be considered gambling. All of this information can be applied to cryptocurrency trading as well, so read more below.

Also please check our post about pros and cons of digital currency.

What is Trading?

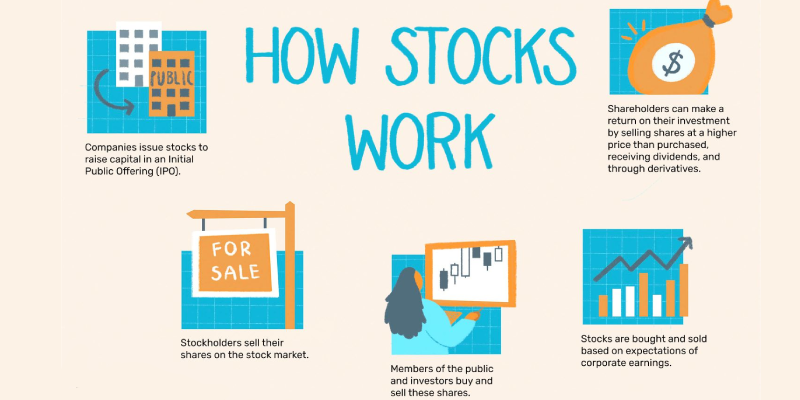

Trading is a financial activity involving buying and selling different types of securities to make profits. Traders purchase assets such as stocks, bonds, commodities, currencies, or derivatives with the intention of profiting from price movements. Most traders use fundamental and technical analysis to determine when to buy and sell, and they often use complex strategies to increase their chances of making a profit. You can also trading cryptocurrencies.

What is Gambling?

Gambling sometimes called betting (there are some differencies also) is the act of placing a wager on an event or outcome with no certain knowledge of what will happen. People gamble because they hope to win money or other prizes, but in most cases, there is no guarantee that they will be successful. Gambling typically involves some element of luck, but it is also possible for people to use strategies and tricks to increase their chances of winning.

The crypto betting site is a newer type of gambling. Although it’s less regulated than traditional online sportsbooks, it still offers many of same sports and events as the more established platforms. You can place bets on any sport or other topic with your crypto coins at these online gambling websites.

Is Trading like Gambling?

So is trading like gambling? Trading and gambling differ in the sense that traders are able to analyze markets and make informed decisions about when to buy and sell. On the other hand, gambling involves placing bets on outcomes that are largely based on luck. Therefore, Trading can be considered to be a form of investing, while gambling is more akin to speculation.

Some differences between Trading and Gambling

We would like you to introduce some differences between trading and gambling.

1. Buying and selling securities

When trading securities, buyers are typically looking for long-term investments, while sellers are looking to take profits and exit their positions. The main difference between buying and selling securities is that buyers are looking for capital gains, while sellers are looking to realize a profit on their investment. When buying securities, investors take a long position in the market, while when selling securities, they take a short position. Buying securities gives the holder ownership of the asset while selling them short means that you borrow the security from someone else and sell it in the hope of being able to buy it back at a lower price.

2. Price determination

The price of a security is determined by supply and demand in the market. When there is more demand for security than there is supply, the price will go up, and when there is more supply than demand, the price will go down. Traders use various tools and techniques to determine where the market is heading and make informed decisions about whether or not to buy or sell. Gambling does not involve any analysis of the markets or understanding of supply and demand. Instead, gamblers typically rely on luck or superstition to help them make winning bets.

3. Risk/reward

Trading involves taking calculated risks in order to maximize rewards. Traders use various tools and techniques to understand the markets and make informed decisions about when to buy or sell. This means that traders are able to minimize their risk while trying to maximize their potential rewards. Gambling, on the other hand, is a game of chance and luck. Gamblers typically have no control over their outcomes, and therefore they are unable to manage their risk or maximize their rewards.

4. Strategies

Traders use various strategies to increase their chances of making a profit in the markets. These strategies involve technical analysis, fundamental analysis and sentiment analysis, among others. Traders use these techniques to make informed decisions about when to enter and exit positions in the markets. Gambling does not typically involve any analysis of the markets or strategies for increasing winning chances. Instead, gamblers typically rely on luck or superstition to help them make winning bets.

5. Profits/losses

Traders are typically able to make profits from their trading activities as long as they are able to make the right decisions about when to enter and exit positions in the markets. However, traders may also incur losses if the market does not behave as expected. Gambling is a game of chance, so gamblers can never be sure of making a profit from any bets that they place. In fact, it is likely that gamblers will end up losing more money than they win over time.

6. Regulatory environment

Trading activities are regulated by governments and financial authorities around the world. These regulations ensure that traders have access to fair and transparent markets while also protecting them from fraudulent activity. Gambling, on the other hand, is typically not regulated. This means that gamblers may be exposed to unscrupulous operators who are taking advantage of them.

7. Market movements

Traders use various tools and techniques to analyze the markets and determine where they are heading in order to make informed decisions about when to enter and exit positions. Gamblers do not typically take into account any market movements or analyses when placing their bets. Instead, they rely purely on luck or superstition to determine their outcomes.

8. Time horizon

Trading activities can be conducted over a short-term period (day trading) as well as for longer periods of time (swing trading). The length of time that traders hold onto their positions depends on their strategies and the market conditions. Gambling typically involves making bets over short periods of time, such as a few minutes or hours. It is not typically suitable for longer-term investments.

Is Stocks Gambling?

In short, stock trading is not gambling. It requires a thorough knowledge of the markets and an understanding of where they are heading in order to make informed decisions about when to buy or sell stocks. Gambling, on the other hand, does not involve any analysis or strategies and simply relies on luck to determine outcomes.

Is Trading the Same as Gambling?

And the last question is trading the same as gambling? No, trading is not the same as gambling. Trading involves taking calculated risks in order to maximize rewards, while gambling is a game of chance with no control over outcomes. Trades also need to use various tools and techniques to analyze the markets before making any decisions, whereas gamblers typically rely solely on luck or superstition when placing bets.

Trading and gambling are two very different activities. Trading involves taking calculated risks in order to maximize rewards, while gambling is a game of chance with no control over outcomes. Traders need to use various tools and techniques to analyze the markets before making any decisions, whereas gamblers typically rely solely on luck or superstition when placing their bets. It is, therefore important for anyone considering Trading or investing in stock markets to understand the differences between these two activities.

What is Trading?

Trading is a financial activity involving buying and selling different types of securities to make profits.

What is Gambling?

Gambling is the act of placing a wager on an event or outcome with no certain knowledge of what will happen.

Is Stocks Gambling?

In short, stock trading is not gambling. It requires a thorough knowledge of the markets and an understanding of where they are heading in order to make informed decisions about when to buy or sell stocks. Gambling, on the other hand, does not involve any analysis or strategies and simply relies on luck to determine outcomes.

Is Trading the Same as Gambling?

No, trading is not the same as gambling. Trading involves taking calculated risks in order to maximize rewards, while gambling is a game of chance with no control over outcomes.