Crypto Scalping Strategies

Crypto scalping strategies are a popular short-term crypto trading strategies that involves making multiple small profits on small price movements of cryptocurrencies.

Scalpers try to make many trades throughout the day and take advantage of small price changes to make quick profits.

In this article, we will discuss what exactly crypto scalping is, how it works, and so on.

What exactly is scalping crypto?

Scalping is a trading style where you try to profit from many small price movements throughout the day.

In the next few lines, I will explain the basics of crypto scalping to help beginners understand how to successfully scalp cryptocurrencies.

Quick summary:

- ✔️ Crypto scalping is all about profiting from lots of small price movements rather than big swings.

- ✔️ Volatility, 24/7 markets, and leverage make cryptocurrencies ideal for crypto scalping strategies.

- ✔️ To be successful, you need to master chart analysis, make rational trading decisions, and apply risk management and mental discipline.

- ✔️ Use exchanges with low fees, suitable order types, and charting functions.

- ✔️ Use stops, risk/reward ratios, and appropriate position sizes to limit risk.

- ✔️ Program your strategies into bots or Expert Advisors to perform automated scalping.

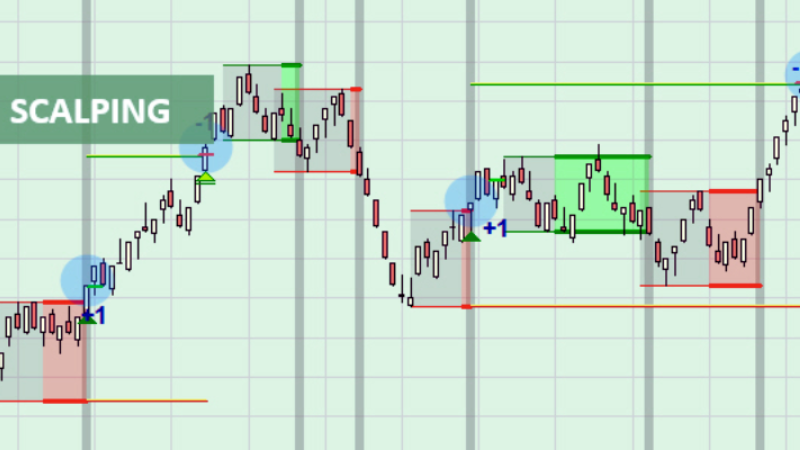

Effective Crypto Scalping Strategies

Here are some effective cryptocurrency scalping strategies that crypto traders use:

Range trading

- ✔️ Identify crypto prices that move in a range between clear support and resistance levels.

- ✔️ Buy near support, sell near resistance.

- ✔️ Close positions quickly for small profits when the price fluctuates within the range.

- ✔️ Use tight stops when buying below support and selling above resistance.

Momentum ignition

- ✔️ Wait for breakouts from channels, triangles, wedges, etc. as volume increases.

- ✔️ Enter after the first breakout and aim for a risk/reward ratio of 1:2 or 1:3.

- ✔️ Tighten the stops below the structure for long positions and above for short positions.

- ✔️ Close a partial position to secure profits if the trade develops positively.

Reversal trading

- ✔️ Watch out for overbought/oversold signals such as RSI (Relative Strength Index) divergences.

- ✔️Enter pullbacks after the first reversal candle.

- ✔️Close a partial position on the following move in the reversal direction.

- ✔️ Tighten stops just outside the high/low.

News Fade Scalping

- ✔️ Watch out for coins that rise 20% on big news.

- ✔️ Enter with a tight stop 5-10% below the high.

- ✔️ Close part of the position on a 10-20% retrace.

- ✔️ Tighten the stop below the highs of the smaller fluctuations.

Scalping with moving averages

- ✔️ Use 5/10/20 period MAs ( Moving Average Strategies) to determine the trend and entry point.

- ✔️ Go long on bullish crossovers, exit on bearish crossovers.

- ✔️ Use other indicators (RSI or Moving average convergence/divergence) for additional confirmation.

- ✔️ Keep targets modest at 2-3x risk

How does scalp trading work?

Scalpers open and close positions within minutes or seconds and try to take profits from the bid-ask spread.

The goal is to accumulate small profits that add up over time. A scalper may make hundreds of trades in a single day while holding their positions for only a few minutes or less. They use leverage to maximize their profits from small fluctuations.

Some key characteristics of scalping in cryptocurrencies

- ✔️ High trading volume: scalpers place many trades per day and focus on the volume rather than the amount of profits.

- ✔️ Short holding times: Positions are closed out quickly, often within 1-5 minutes.

- ✔️ Small profit margins: Scalpers aim for small gains per trade, usually 0.5% or less.

- ✔️ Risk management: Strict stops are used to minimize losses on losing trades.

- ✔️ Technical analysis: Scalpers rely on technical indicators such as moving averages to identify trading opportunities.

- ✔️ Scalping is suitable for traders who can devote a lot of time to observing the markets and managing positions. It requires mental stamina, discipline, and a quick reaction time.

How to scalp cryptocurrencies?

Profitable cryptocurrency scalping requires skill, diligence, and care. Here are some proven strategies and tips for scalping cryptocurrencies:

Find a volatile cryptocurrency

Make sure to scalp cryptocurrencies that have strong intraday price movements and high daily trading volumes. Ideal scalping cryptocurrencies fluctuate by 3% or more on an intraday basis.

Coins such as Bitcoin, Ethereum and Litecoin are a good choice. Avoid stable coins or coins with low trading volume.

Use an exchange with low fees

To maximize profit margins, scalpers need to use spot exchanges with low trading fees, a good selection of trading pairs and liquidity. Compare fee structures before choosing an exchange.

Recommended exchanges include Bitget, Gate.io, Bybit, and Binance. Some exchanges offer fee discounts if you hold their native token or pay the fees in their token.

Master Chart Reading

Successful scalping relies heavily on technical analysis. Trading charts, patterns, indicators and candlestick formations are an important part of your arsenal of skills.

Key analysis skills for scalpers include recognizing support and resistance levels, spotting trend reversals, using moving averages and recognizing bull/bear flags, triangles and wedges.

Use limit orders

Place limit buy/sell orders at optimal entry and exit points instead of using market orders. This will ensure you get the fill price you want and avoid paying taker fees.

Set your orders just above or below key technical levels so that they have the greatest chance of being filled before the market moves away.

Manage risk carefully

Good risk management is crucial when scalping. Use stop-loss orders on every trade to limit losses. Do not risk more than 1% of your trading capital per trade.

Also, avoid excessive leverage. Use leverage that allows sufficient margin to avoid liquidation during normal volatility.

Develop a trading plan

Create a detailed trading plan that includes your risk/reward objectives, preferred setups, strategies, trading times, position sizes, and more. Trading without a plan leads to emotional mistakes.

Stick strictly to your plan. Do not deviate from your risk limits, and do not pursue trades that do not meet your criteria.

Be disciplined

Scalping requires a high degree of mental discipline. Avoid impulsive trading and overtrading at all costs. If your rules say an opportunity is not optimal, don’t take the trade even if it feels right.

Stay calm and stick to high-probability setups. Don’t chase breakouts, and don’t sell pullbacks in a panic.

Common scalping mistakes

Here are some common mistakes crypto scalpers should avoid:

- ✔️ Not using stop losses – Not using protective stops is a surefire way to get wiped out from big losses. Always use stops.

- ✔️ No trading plan – Trading blindly without a strategy leads to irrational trading and chasing losses. Set a trading plan and follow it.

- ✔️ Overtrading – Scalping profits requires quality, not quantity. Limit your trades to the best setups.

- ✔️ No risk management – Failure to limit position sizes and risk per trade leads to account destruction due to overleveraging.

- ✔️ Revenge trading – Don’t double down after losses to try to recoup them immediately. Stick to your tried and tested strategy.

- ✔️ Don’t take profits – Take partial profits while trading to lock in profits from successful trades. Don’t get greedy.

- ✔️ Add to losers – Avoid adding to losing positions. Close losing trades when they reach the stop to limit risk.

- ✔️ Ignore fees/slippage – Consider how fees and slippage affect profit targets. Factor them into position size and targets.

- ✔️ With the right precautions, these common mistakes can be avoided to develop a scalping method that delivers lasting profits.

Crypto scalping can be rewarding, but requires flexibility and strict trading protocols. With the right foundation, crypto scalpers can make lasting profits from the digital asset markets.

Conclusion

Crypto scalping is a popular short-term trading strategy that leverages small price movements in cryptocurrencies to generate multiple small profits throughout the day.

This approach demands adept technical analysis, disciplined risk management, and a keen understanding of market dynamics.

While crypto scalping offers opportunities for quick gains, traders must remain vigilant against common pitfalls such as overtrading, lack of risk management, and emotional decision-making.

By following proven strategies and maintaining a robust approach, traders can unlock the potential of crypto scalping to achieve sustainable profitability in digital asset markets.

F.A.Q

What is crypto scalping❓

Crypto scalping is a short-term trading strategy where traders aim to profit from small price movements in cryptocurrencies by making frequent trades throughout the day.

What is crypto scalping strategy❓

Crypto scalping is a trading strategy that involves making numerous trades over short periods within the cryptocurrency market to profit from small price movements.

How does crypto scalping differ from other trading strategies❓

Unlike long-term investing or swing trading, crypto scalping focuses on exploiting short-term price fluctuations to generate quick profits, often within minutes or even seconds.

What are the key characteristics of successful crypto scalping❓

Successful crypto scalping requires a combination of technical analysis skills, quick decision-making abilities, disciplined risk management, and the capacity to monitor the markets closely for trading opportunities.

Which cryptocurrencies are suitable for scalping❓

Scalping is best suited for cryptocurrencies with high liquidity and volatility, such as Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), as they offer ample trading opportunities within short time frames.

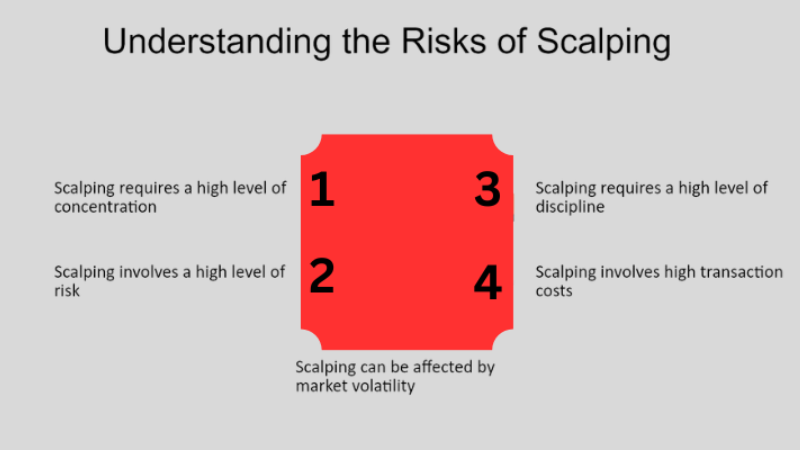

What are the risks associated with crypto scalping❓

Risks include rapid market fluctuations, execution delays, slippage, and increased exposure to trading fees. Additionally, the intense focus required for scalping can lead to emotional stress and fatigue.